The invention of metal coins once fueled early trade, but the emergence of paper money marked a true revolution in human finance. It brought unprecedented flexibility to economic activity and reshaped global commerce.

However, since paper currency can be copied, its anti-counterfeiting technology has always been crucial to maintaining public trust and financial stability.

1. The Origins: Visible Features and Early Printing Skills

More than a thousand years ago, China’s Northern Song Dynasty introduced Jiaozi, the world’s first paper money — and with it, the first efforts in banknote security.

Early Chinese notes used special mulberry bark paper and official seals to prevent forgery. During the Yuan Dynasty, paper made from mulberry fibers gave the notes a unique texture and ink tone that were difficult to imitate.

Even earlier, Tang and Song artisans had developed patterned watermark paper, the forerunner of modern watermark technology.

At the same time, Europe was developing its own approaches. In the 17th century, Sweden issued the first modern paper notes. Soon after, Britain and France improved their printing methods with engraved intaglio designs, watermarks, and special inks.

The Industrial Revolution in the 19th century brought precision printing techniques, including fine-line engraving, microtext, and guilloché patterns. These innovations laid the foundation for the modern banknote’s complex and detailed anti-counterfeiting systems.

2. The Rise of Modern Security: Optics at the Core

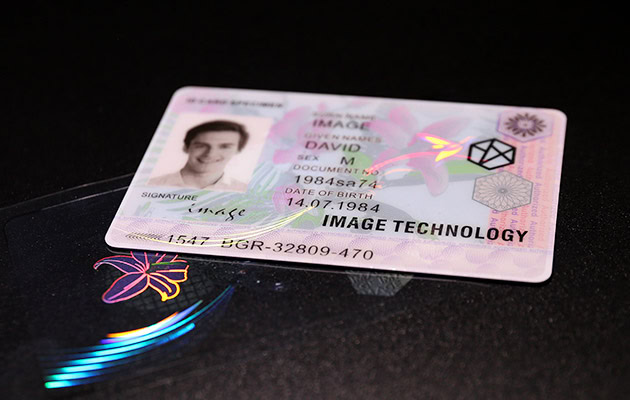

By the 20th century, banknote protection had evolved into a multi-layered defense system. While traditional paper and printing safeguards remained essential, optical technologies became the new core of currency security.

Examples include the holographic security threads in British notes, color-shifting inks and transparent windows in the Euro, and security fibers and invisible inks used in the U.S. dollar.

China’s renminbi (RMB) has also progressed rapidly. From the magnetic security thread in the 1999 series to holographic microtext and windowed threads in later editions, the RMB now fully integrates optical features as a key protection layer.

The 2019 edition’s dynamic color-shifting windowed thread marked a milestone in China’s independent innovation and alignment with global currency security standards.

3. The Future: From Technology to Trust

A banknote is often called the “business card of a nation.” Beyond its monetary function, it represents a country’s achievements in technology, art, and security. Even as digital currencies rise, physical banknotes remain an enduring symbol of trust.

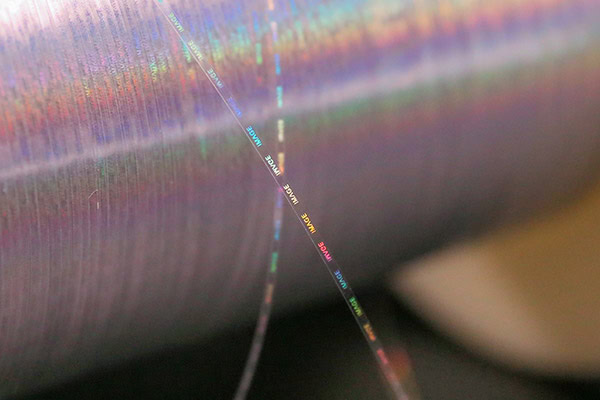

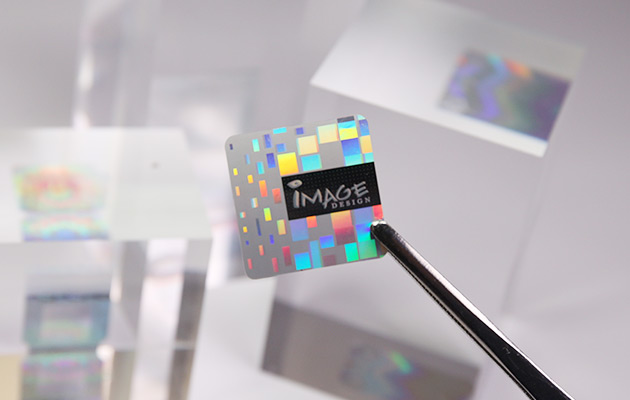

In the future, banknote security will continue to merge physical, digital, and intelligent technologies. Holographic images, micro-nano structures, AR recognition, and blockchain-based traceability are shaping a new security ecosystem — one where each note carries a verifiable digital identity.

For over two decades, Image Technology has been dedicated to optical anti-counterfeiting innovation, guided by the principle of being hard to forge, easy to verify, and cost-effective. As technology advances, optical security will remain a cornerstone in protecting the integrity of global currency systems.